Instaclear Clearing Services

-

The payments industry now is changing - up to now the clearing is based on a clearing house like SWIFT which represents the trusted 3rd party in the exchange of money.

-

One of the main benefits of blockchain is that it offers a more efficient and effective clearing and settlement process.

-

Blockchain technology is more and more applied to financial sector use cases, in particular digital assets. All kinds of assets can be mapped on blockchain-based systems.

-

One of the greatest benefits of using blockchain technology for digital assets is substantial efficiency gains within the settlement process.

-

This move of settlement processes to decentralized technologies makes the settlement process more efficient as it decreases the associated transaction costs and reduces involved risks The transfer of funds is based on contracts which can be in USD, EUR, ZAR, local currency, and even bitcoins.

-

The agreements between the Central Banks are the same as within the existing Clearing.

More Profits in the Countries

-

instaclear provides a simple and easy integration of the block chain clearing. It is tested between the Tunisian and French Central Bank and between the Tunisian and Libyan Central Bank.

-

Each new participating countries central bank has to have their partner countries involved starting with the implementation of testing and certifying instaclear. With this approach all countries in Africa will benefit from instaclear`s real-time and very economic clearing.

-

At each deployment of a new country connections will be immediately available to all connected countries without the need to have a point-to-point integration between each points.

-

The suggested deployment approach allows for the scalability of the architecture to include all African countries and cope with the requirements and the timelines of each country.

-

The solution allows for an easy integration by adopting an API based connections to existing systems.

-

Comprehensive testing will be conducted according to a predefined list of scenarios including unitary and end-to-end simulations. A period of 6 week, with the support of instaclear team, is sufficient to ensure all test use cases are performed.

Contact us

Get contact informationSimple System Design

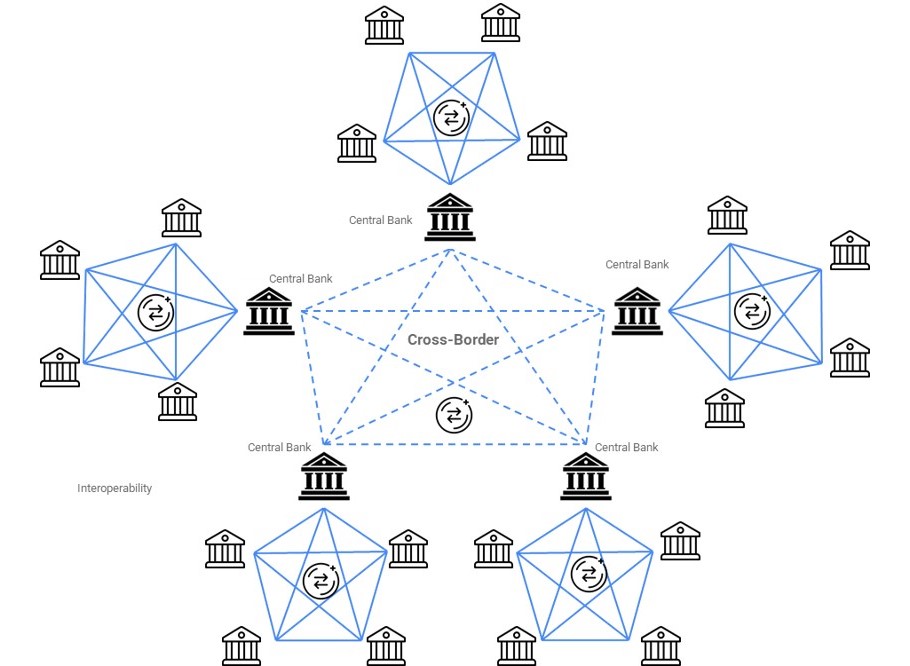

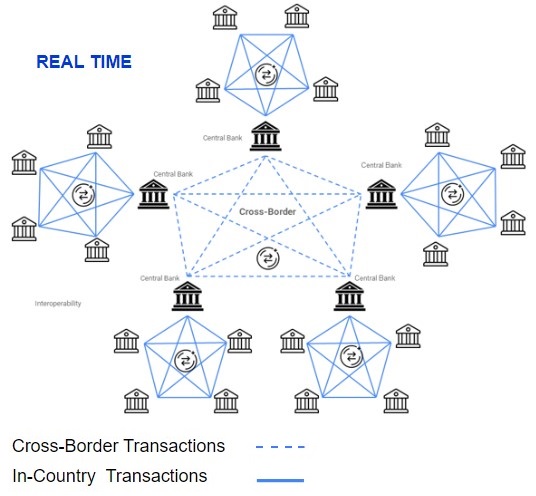

NATIONAL AND INTERNATIONAL TRANSFERS

- Different nodes are implemented, one for each country (central bank) with complete view on transactions

- Different digital assets could be used as a support for transactions and could evolve in the future to integrate CBDC (central bank digital currency)

- AML controls and Al enabled compliance modules could also be integrated depending on actual country requirements

- The system is extendable to enable countries to improve local payment infrastructure and evolve towards in-country instant payment

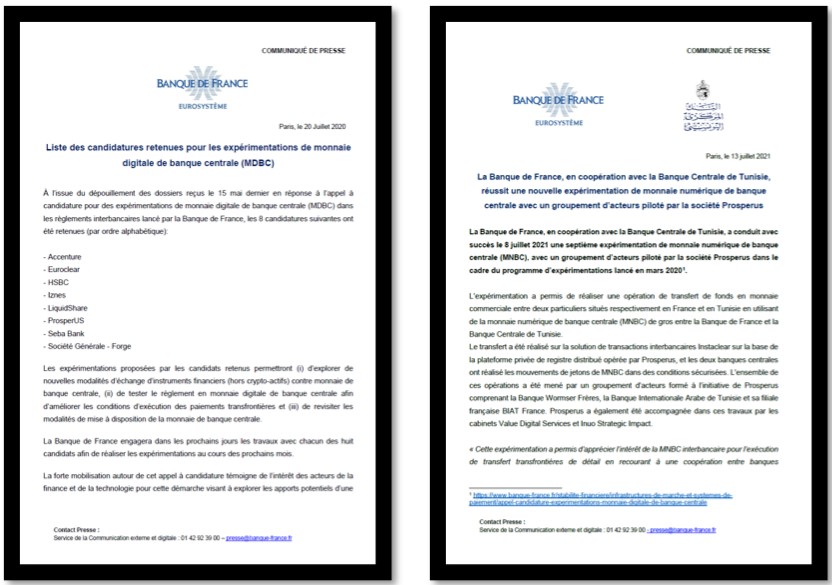

Successful experimentation with Banque de France

-

The experimentation carried out a wire transfer between two individuals, located respectively in France and Tunisia, in commercial bank money through transfer of wholesale central bank digital currency (CBDC) between Banque de France and Banque Centrale de Tunisie.

-

The operation took place on the Instaclear interbanking transaction solution based on the private distributed ledger operated by Prosperus, and both central banks have exchanged CBDC tokens in secured conditions.

Instaclear the winning Solution

Flexible interface

- APIs for a flexible integration

- File Import and Transfer

- Web and Manual

- Other Interfaces

- Adaptable integration

Reporting and admin tools

- User and access management

- Adaptable reports

- Data analytics capabilities

Overall advantages

The instaclear base has been tested successfully in operational environnements enabling cross-border transfers involving multiple central banks.

- Real time Clearing

- Secure platform ensuring integrity and non-repudiation of transactions

- Flexible for different clearing purposes (Transfers, securities settlement)

- DLT technology implemented in a Private and Permissioned design ensuring confidentiality and scalability of the solution

- Adapts to different digital asset types according to regulator requirements

Security

-

Instaclear is built on top of a highly secured DLT infrastructure ensuring confidentiality and integrity of transactions.

-

The underlying technology is based on Ed25519 signatures, one of the most secure and highly efficient cryptographic mechanisms allowing for:

-

Instaclear teams will ensure a 24/7 support level during implementation and operations of the platform and will ensure regular software maintenance and update with at least two software releases per year and patches as required.